INRx Pay App

Crypto UPI App Utility Payment with Crypto

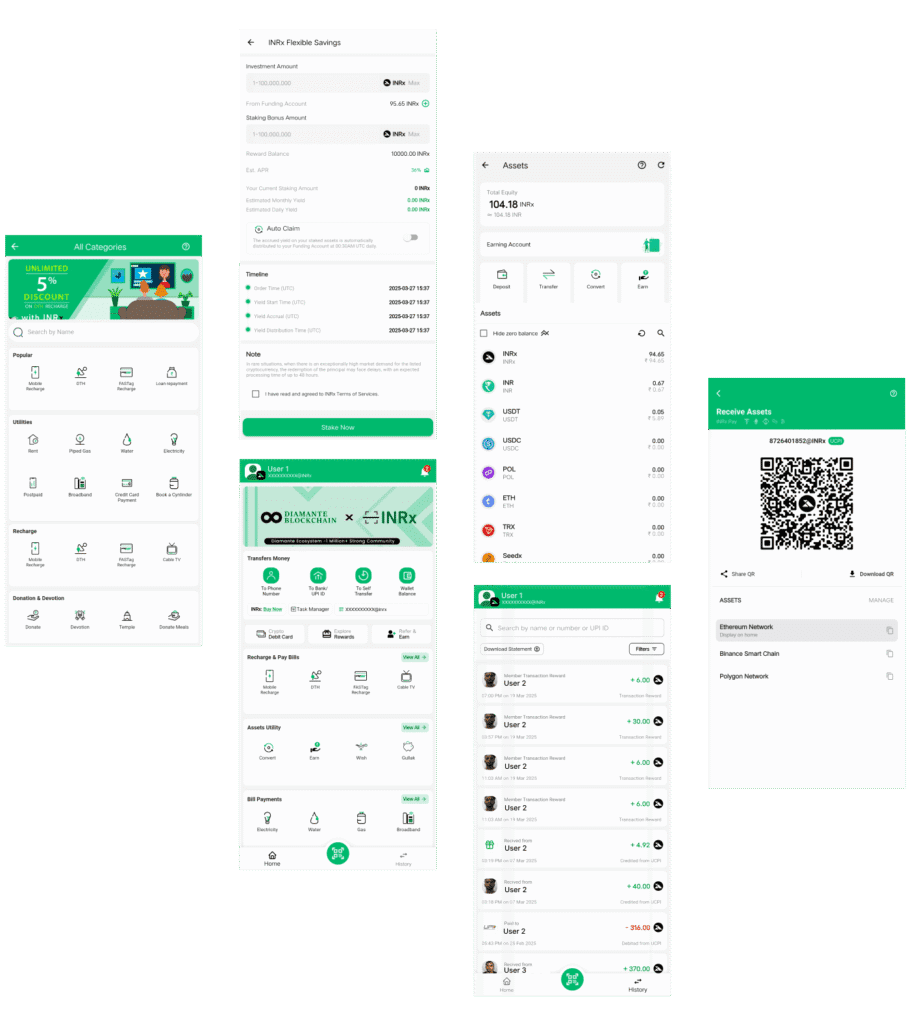

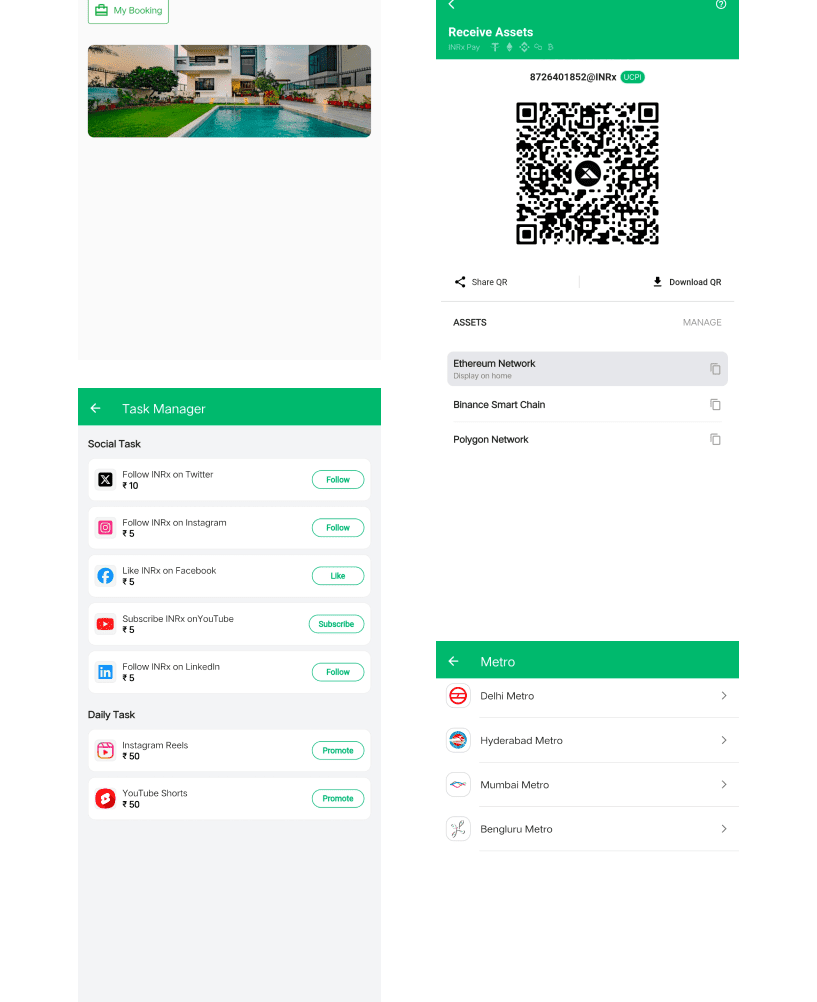

INRx Pay is a Crypto UPI App designed for seamless utility payments with crypto. Users can perform mobile recharges, BBPS payments, UPI transactions, and crypto-to-INR transfers, ensuring a smooth and efficient crypto payment experience for everyday transactions.

Client Requirements

The client required a crypto payment app that enables seamless day-to-day transactions, including mobile recharges, bill payments, UPI transfers, bank transfers, and self-transfers. The platform needed to integrate crypto-to-INR conversion, ensuring easy adoption for users transitioning from traditional banking to blockchain-based transactions.

1. Transfer Money: The client wanted a fast and secure way to transfer funds using phone numbers, bank accounts, and UPI IDs. The app needed to facilitate instant payments and support both fiat and crypto transactions with low fees.

2. Wallet Balance: A multi-currency wallet was required to store and manage both crypto and fiat balances. The client wanted real-time balance tracking, easy top-ups, and seamless fund transfers between different wallets.

3. Recharge & Pay Bills: The client emphasized integrating services for mobile, DTH, and utility bill payments using crypto. This required linking with BBPS and service providers to ensure a smooth transaction experience.

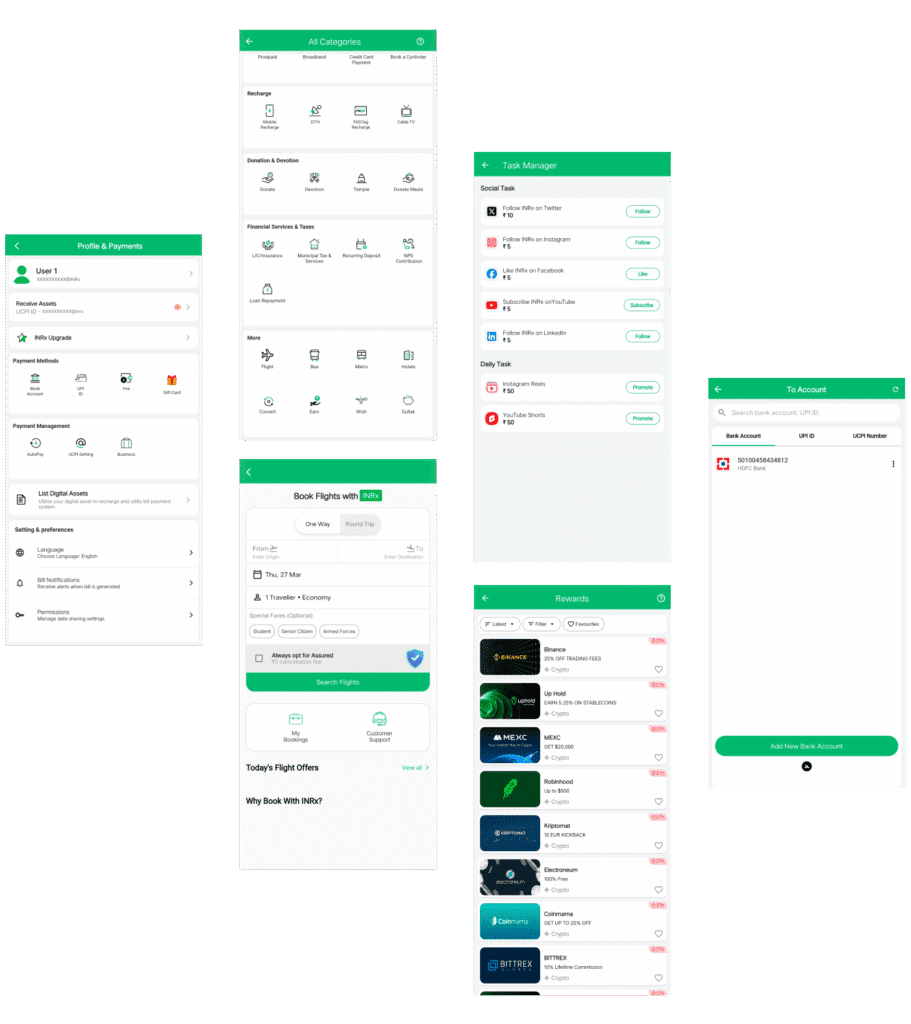

4. Travel Booking: A complete travel booking feature was needed for flight, bus, and metro card recharges. The system had to process payments in crypto while ensuring competitive pricing and secure bookings.

5. Hotel Booking: Users needed an option to book hotels using crypto payments. The app had to aggregate hotel listings and provide seamless payment integration for a smooth customer experience.

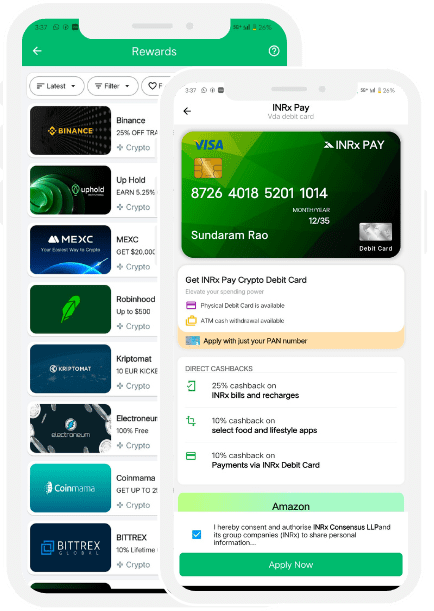

6. Crypto Credit/Debit Card: The client wanted a feature allowing users to spend crypto like fiat through a virtual or physical debit/credit card. This required seamless conversion and merchant support.

Features

Get Started with this product

Money Transfer

Users can securely transfer money through phone numbers, bank accounts, and UPI. Transactions are instant, decentralized, and hassle-free, offering the same convenience as banking with blockchain-backed safety.

Wallet Balance Management

A multi-currency wallet system tracks balances in real-time, allowing smooth fund transfers and accurate updates. The intuitive interface simplifies managing crypto holdings while ensuring financial transparency, speed, and security always.

Bill Payments & Recharge

Users can pay bills for electricity, gas, water, and broadband or recharge mobile, DTH, and metro instantly. Cryptocurrency payments ensure secure, reliable, and efficient financial solutions for daily needs.

Travel & Hotel Booking

Users can book flights, trains, buses, metro rides, and hotels directly using cryptocurrency. Partnered integrations promote seamless global adoption, making real-world travel payments more practical, transparent, and efficient overall.

Self-Transfers & Crypto-to-INR Conversion

Funds can be transferred across wallets or converted instantly from crypto to INR. This ensures liquidity, quick access, and trusted security, bridging the gap between digital currencies and practical usability.

Crypto Debit/Credit Card Support

Users get virtual and physical debit or credit cards to spend cryptocurrency globally. This feature ensures digital assets function like fiat, promoting wider mainstream adoption in everyday purchases worldwide.

More Screens

Consensus Mechanism

Proof of Authority (PoA)

PoA ensures high-speed transactions by relying on a select group of trusted validators. This mechanism eliminates the need for energy-intensive mining, making transactions faster and cost-efficient while maintaining security, making it ideal for financial applications like INRx Pay.

Delegated Proof of Stake (DPoS)

DPoS enhances scalability by allowing users to vote for delegates who validate transactions on their behalf. This consensus mechanism ensures secure and efficient processing, reducing latency and improving transaction throughput, making it well-suited for handling large-scale crypto payments seamlessly.

Proof of Stake (PoS)

PoS enables energy-efficient, decentralized validation by requiring validators to hold and stake tokens. This approach ensures security while reducing computational costs, leading to faster transaction processing for crypto payments. Its decentralized nature also enhances network resilience against attacks and manipulation.

Layer 2 Scaling

Layer 2 solutions help reduce congestion by processing transactions off-chain while securely settling them on the main blockchain. This approach improves transaction speed, minimizes costs, and ensures a seamless user experience, particularly in high-volume payment applications.

Byzantine Fault Tolerance (BFT)

BFT provides protection against malicious nodes by ensuring that the network reaches consensus even if some validators act dishonestly. This mechanism guarantees high-speed and reliable crypto transactions, making it an essential component for secure and resilient financial networks like INRx Pay.

Hybrid Consensus

Combining PoS and BFT, hybrid consensus enhances scalability and security. It allows for efficient transaction processing while safeguarding against fraudulent activities. This model ensures smooth and safe financial transactions, making it an optimal choice for blockchain-based payment systems like INRx Pay.

Colors & Typography

Open Sans, sans-serif

Aa Bb Cc Dd Ee Ff Gg Hh Ii Jj Kk Ll Mm Nn Oo Pp Qq Rr Ss Tt Uu Vv Ww Xx Yy Zz

Project Approach & Results

Project Approach

The development of INRx Pay followed a systematic approach, starting with detailed research into blockchain technology and existing digital payment systems. The objective was to design a crypto-powered UPI system capable of handling seamless everyday transactions. A strong emphasis was placed on user-centric design, ensuring the platform offered an intuitive interface and effortless navigation. Features such as bill payments, mobile recharges, fund transfers, and travel bookings were included after studying real-world requirements. Security frameworks and regulatory compliance measures were carefully prioritized, enabling trust and scalability for mass adoption. Rigorous testing, security audits, and iterative improvements were conducted to enhance stability, efficiency, and reliability. This structured development ensured the platform could deliver performance consistency before deployment and public availability.

Project Results

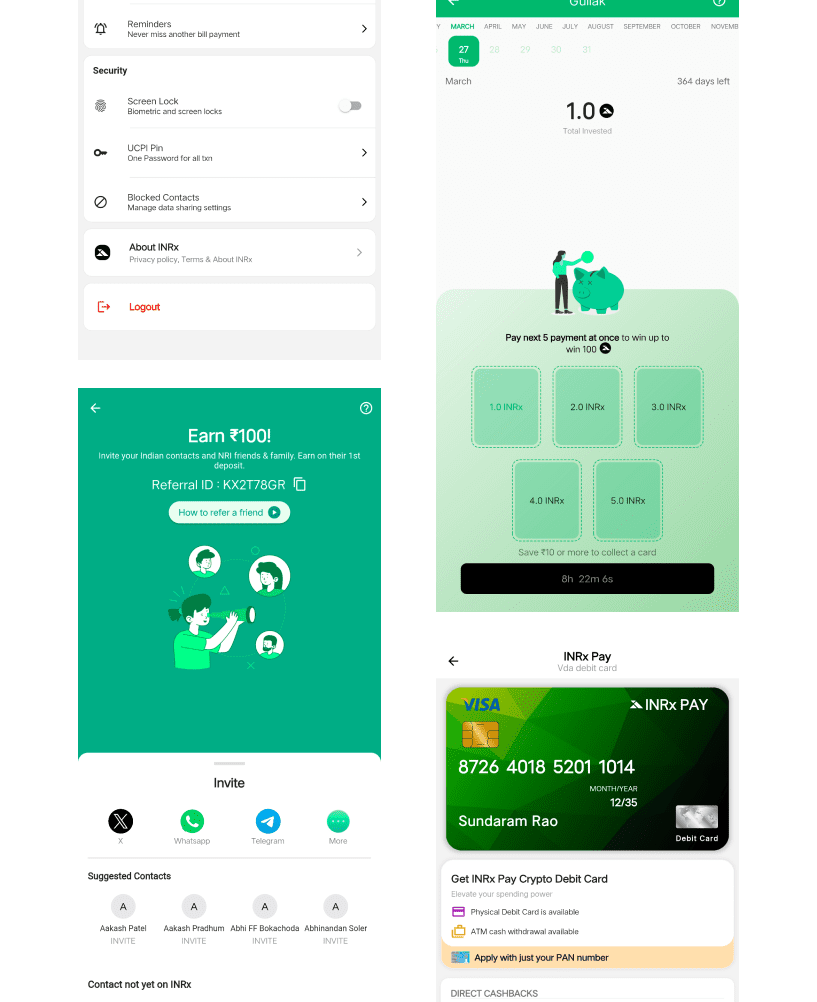

INRx Pay successfully launched as a breakthrough Crypto UPI Payment Platform, enabling users to complete instant fund transfers, bill payments, and travel bookings conveniently with digital assets. Its simplified interface and reliable security attracted a wide audience, gaining strong traction among early adopters. Feedback emphasized smooth functionality, regulatory reliability, and practical daily usability. The addition of both virtual and physical crypto debit or credit cards further enhanced adoption, bridging cryptocurrency with mainstream financial systems globally. INRx Pay played a significant role in connecting blockchain innovation with everyday finance, encouraging wider adoption of digital assets. Regular updates and feature expansions helped ensure constant improvements. Sustained platform growth ultimately positioned INRx Pay as a reliable and trusted financial services solution.

Challenges

1. Regulatory Compliance

Navigating regulatory challenges around crypto payments required continuous adaptation to evolving financial laws and government policies. Ensuring compliance while maintaining decentralization was a key challenge. Collaboration with legal experts and financial institutions helped establish a framework that balanced innovation with legal security, fostering trust.

2. User Adoption

Encouraging mass adoption of crypto-based payments involved simplifying the onboarding process and educating users about digital transactions. Many users were unfamiliar with blockchain technology, requiring intuitive interfaces and educational content. Strategic partnerships and incentive programs further drove engagement, making crypto payments more accessible.

3. Security Concerns

Ensuring robust security mechanisms was essential to prevent fraud, hacking, and unauthorized transactions. Multi-layer encryption, biometric authentication, and AI-driven fraud detection were implemented to safeguard user assets. Continuous security audits and proactive threat monitoring strengthened platform resilience against cyber threats and vulnerabilities.

4. Liquidity Management

Ensuring robust security mechanisms was essential to prevent fraud, hacking, and unauthorized transactions. Multi-layer encryption, biometric authentication, and AI-driven fraud detection were implemented to safeguard user assets. Continuous security audits and proactive threat monitoring strengthened platform resilience against cyber threats and vulnerabilities.

Technology Stacks

This concise overview highlights the key components of the technology stack powering INRx Pay, ensuring secure, efficient, and seamless transactions for its users.

Related Posts

Blockchain Solutions Built to Scale

Nadcab Labs delivers secure, innovative blockchain and crypto apps — fast, reliable, and future-ready. Let’s build your next-gen decentralized platform.

Contact Us