Key Takeaways

- •Crypto exchange APIs serve as the technological backbone that enables programmatic access to trading platforms, powering everything from automated trading systems to institutional-grade infrastructure

- •REST APIs handle request-response operations while WebSocket APIs provide real-time data streams, creating a comprehensive framework for market data delivery and trade execution

- •API integration in exchange platforms enables critical functions including liquidity aggregation, multi-exchange order routing, and sophisticated risk management capabilities

- •Secure API implementation requires multi-layered protection including HMAC authentication, IP whitelisting, granular permissions, and comprehensive monitoring systems

- •Scalable exchange platforms leverage API-based microservices architecture, load balancing, and intelligent rate limiting to handle millions of requests during peak trading periods

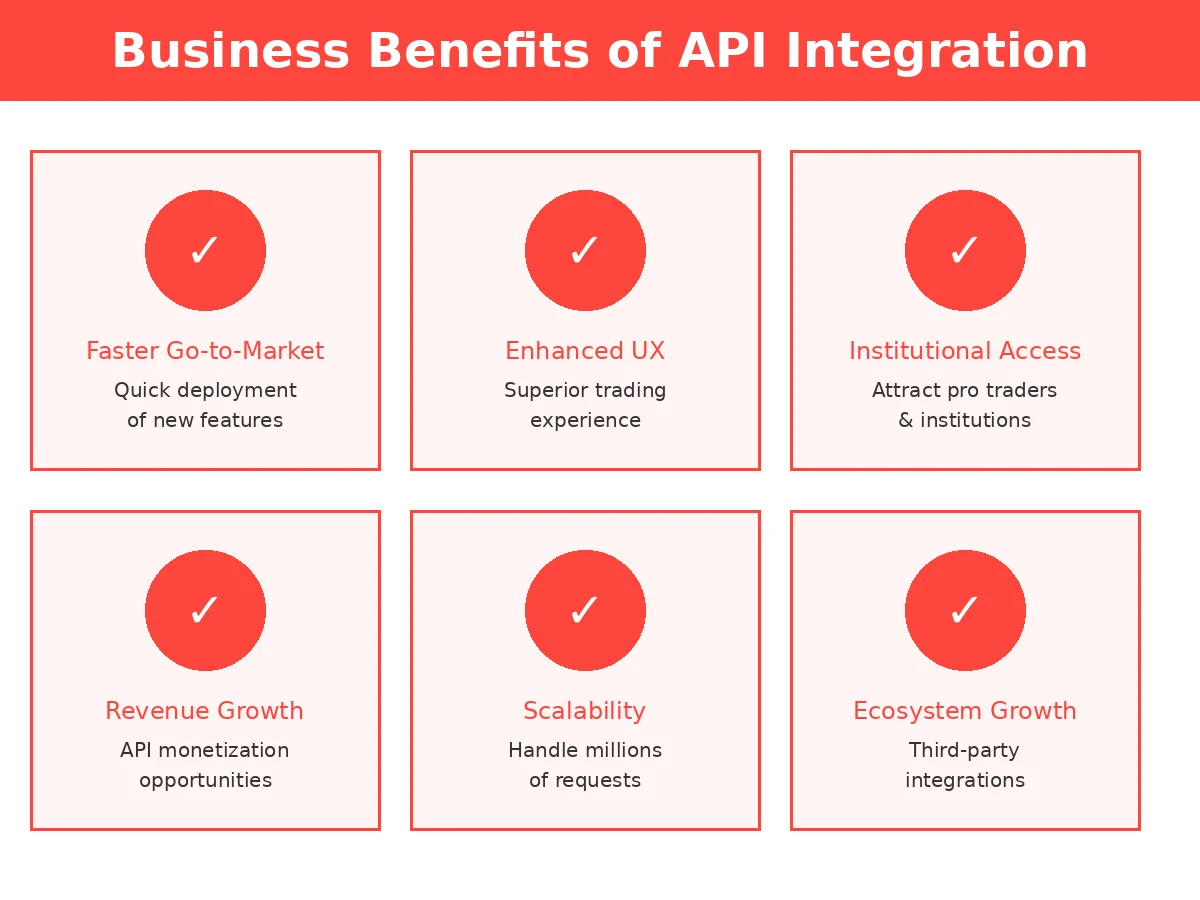

- •Business benefits of robust API integration include faster go-to-market timelines, enhanced user experience, institutional client acquisition, and new revenue streams through API monetization

- •Trading platform API integration enables advanced capabilities such as algorithmic trading, arbitrage execution, portfolio automation, and 24/7 strategy implementation

- •The future of crypto exchange APIs involves AI-driven intelligence, cross-chain interoperability, WebSocket dominance, and standardized protocols that will revolutionize trading infrastructure

What Are Crypto Exchange APIs & How Do They Work?

Crypto exchange APIs are sophisticated software interfaces that create a programmatic bridge between trading platforms and external applications, enabling seamless data exchange and operational control without requiring direct human interaction through web browsers. In the context of cryptocurrency exchanges, APIs serve as the fundamental communication layer that powers modern digital asset trading infrastructure, allowing developers, traders, and businesses to integrate exchange functionality directly into their applications, trading systems, and analytical tools.

At their core, crypto exchange APIs function through standardized protocols that define how applications can request information and execute operations on exchange platforms. When discussing API for crypto exchanges, we are referring to structured endpoints that expose exchange capabilities through HTTP requests and responses. The exchange backend receives these requests, processes them through various internal systems including order matching engines, wallet management infrastructure, and market data aggregators, then returns formatted responses typically in JSON structure that applications can easily parse and utilize.

Understanding how APIs work in exchange platforms requires recognizing two primary architectural patterns that serve different operational needs. REST (Representational State Transfer) APIs operate on a request-response model where applications send specific queries to exchange servers and receive complete responses containing the requested information. These APIs excel at operations such as placing orders, retrieving account balances, accessing historical trade data, and managing account settings. Each REST API call is stateless and independent, making them reliable for transactional operations where confirmation of execution is critical.

Conversely, WebSocket APIs establish persistent, bidirectional connections between applications and exchange servers, enabling real-time data streaming with minimal latency. Rather than repeatedly polling for updates, WebSocket connections allow exchanges to push new information instantly as market conditions change. This architecture is essential for live price feeds, order book updates, executed trade notifications, and other time-sensitive data where millisecond delays can impact trading decisions and profitability.

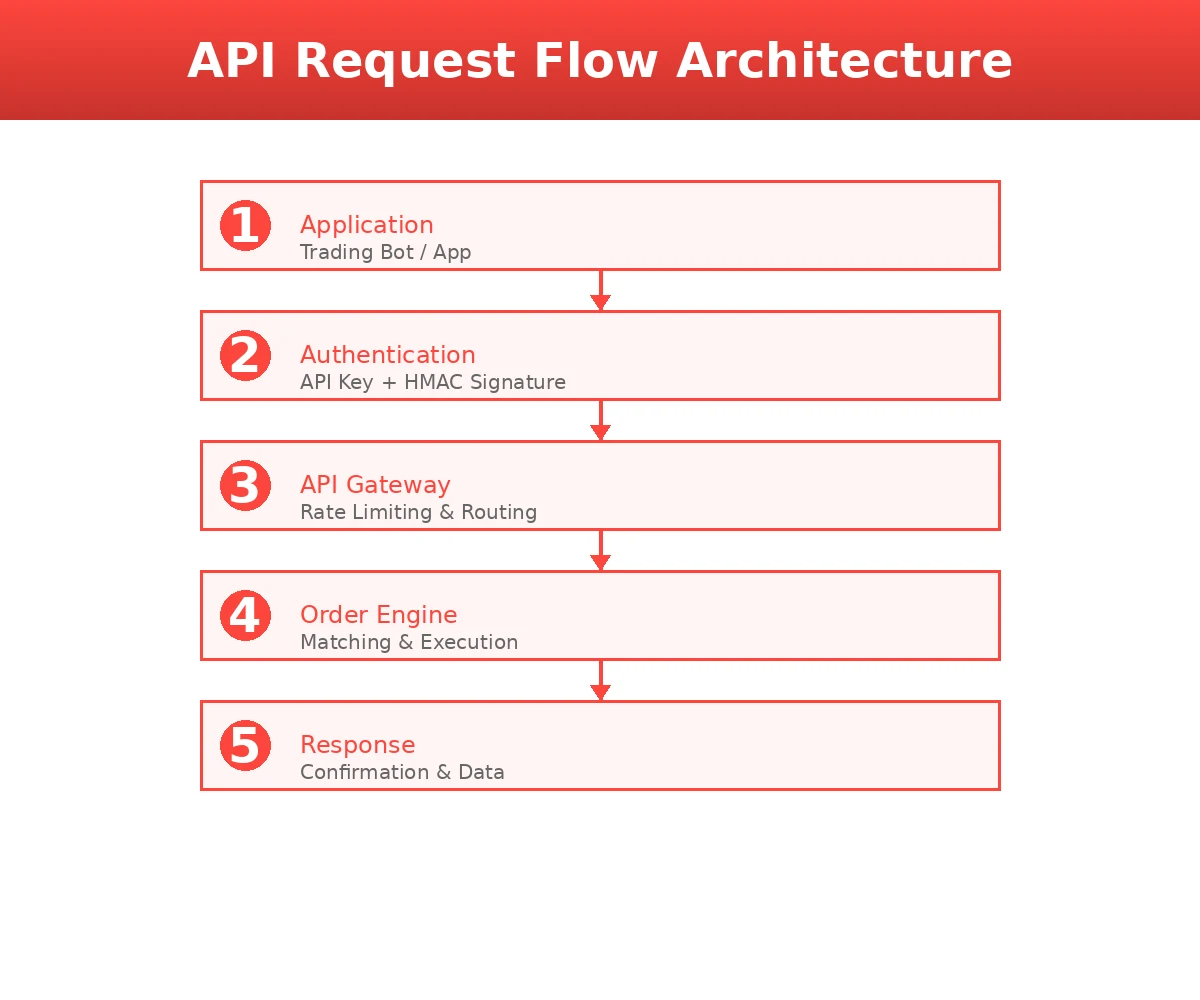

The data flow in crypto exchange APIs follows a carefully orchestrated sequence that ensures accuracy and reliability. Market data originates from the exchange’s order matching engine, which continuously processes buy and sell orders, determines execution prices, and updates order book depth. This information flows through API servers that format and distribute data to connected applications. When traders submit orders through API integration, requests travel from external applications through authentication layers, validation systems, risk management checks, and finally to the order matching engine for execution. The execution results then propagate back through the same path, providing confirmation and updated account states to the originating application.

Modern crypto exchange APIs also incorporate sophisticated features such as rate limiting to prevent system overload, comprehensive error handling to communicate issues clearly, versioning systems to maintain backward compatibility, and extensive documentation that enables developers to implement integrations efficiently. The combination of REST and WebSocket protocols creates a complete API ecosystem where applications can perform any operation available through the exchange’s web interface while achieving superior speed, reliability, and automation capabilities that define professional trading infrastructure.

Role of APIs in Exchange Platforms

The role of APIs in exchanges extends far beyond simple data retrieval, forming the operational foundation that enables modern cryptocurrency trading platforms to function at scale while serving diverse user needs from retail traders to institutional investors. APIs in exchange platforms create the infrastructure layer that separates successful, scalable exchanges from basic trading interfaces, determining platform capability, reliability, and competitive positioning in an increasingly sophisticated market.

Real-Time Market Data & Price Feeds

One of the most critical roles of APIs in exchange platforms involves delivering real-time market data and price feeds with minimal latency. APIs continuously stream current bid and ask prices, last traded prices, 24-hour volume statistics, price change percentages, and other market indicators that traders rely upon for decision-making. Through WebSocket connections, exchanges push order book updates showing available liquidity at each price level, recent trade executions with timestamps and volumes, and ticker data aggregating market conditions across all trading pairs. This real-time data distribution enables price tracking websites, portfolio management applications, trading terminals, and analytical platforms to display accurate market information without building direct exchange integrations.

Order Placement & Trade Execution

The role of APIs in exchanges becomes most evident in trade execution capabilities where APIs transform simple trading instructions into complex multi-step operations. Through authenticated API endpoints, traders can programmatically place market orders that execute immediately at current prices, limit orders that await specific price levels, stop-loss orders that trigger when prices move against positions, and advanced order types including trailing stops, iceberg orders, and time-in-force parameters. APIs handle the complete order lifecycle from submission through validation, matching, execution, and settlement, providing detailed status updates and execution reports. This programmatic order placement enables sophisticated trading strategies that would be impossible to implement through manual web interface interactions, particularly for high-frequency operations or strategies requiring simultaneous execution across multiple trading pairs.

Account, Wallet & Portfolio Management

APIs empower comprehensive account and portfolio management by exposing endpoints that provide complete visibility into trading accounts and asset holdings. Traders can programmatically retrieve current balances across all cryptocurrencies and fiat currencies held on the exchange, access detailed transaction histories including deposits, withdrawals, trades, and fees, view open orders and their current status, and analyze realized and unrealized profit and loss across positions. Wallet management APIs enable deposit address generation for receiving funds, withdrawal initiation with appropriate security confirmations, and transfer operations between exchange wallets and external addresses. Portfolio tracking applications leverage these APIs to aggregate holdings across multiple exchanges, calculate total portfolio value, monitor performance over time, and generate comprehensive reports for tax purposes or investment analysis.

Liquidity Aggregation & Market Depth

Advanced exchanges utilize APIs to aggregate liquidity from multiple sources, creating deeper order books and more competitive pricing for traders. Through API connections with liquidity providers, market makers, other exchanges, and decentralized liquidity pools, platforms can combine available buy and sell orders into unified market depth displays. APIs facilitate smart order routing systems that analyze liquidity across connected venues, determining optimal execution paths that minimize slippage and maximize fill rates for large orders. This liquidity aggregation role demonstrates how APIs enable exchanges to compete not just on their native liquidity but on their ability to access and integrate external liquidity sources, providing traders with better execution quality and tighter spreads than would be possible from a single isolated order book.

API Integration in Exchange Platforms: Core Components

Successful API integration in exchange platforms requires understanding and implementing several core components that collectively ensure secure, reliable, and efficient communication between external applications and exchange infrastructure. These components form the technical foundation upon which all programmatic exchange interactions are built, determining integration quality and operational capability.

Public APIs vs Private APIs

Exchange API integration distinguishes between public and private API endpoints based on the sensitivity of information and operations they provide. Public APIs offer unauthenticated access to general market information including current prices, historical trading data, order book depth, recent trades, exchange statistics, and available trading pairs. These endpoints require no account creation or API keys, allowing anyone to access market data for analysis, price tracking, or research purposes. Public APIs power market data aggregators, price comparison websites, and analytical platforms that monitor cryptocurrency markets without needing direct exchange accounts. Private APIs, conversely, require authentication and provide access to account-specific functions including balance inquiries, order placement and cancellation, trade history retrieval, deposit and withdrawal operations, and account settings management. The separation ensures that sensitive account operations remain secure while maintaining transparency in market data that benefits the broader trading ecosystem.

| Aspect | Public APIs | Private APIs |

|---|---|---|

| Authentication Required | No | Yes (API keys + HMAC signature) |

| Data Access | Market data, prices, order books | Account balances, orders, trade history |

| Operations Allowed | Read-only market information | Trading, withdrawals, account management |

| Rate Limits | Higher limits (e.g., 1200/min) | Lower limits (e.g., 600/min) |

| Security Level | Basic (IP throttling) | High (encryption, IP whitelisting, 2FA) |

| Use Cases | Price trackers, market analysis, charting | Trading bots, portfolio management, automation |

| Account Creation | Not required | Required with KYC verification |

Authentication, API Keys & Permissions

Trading platform API integration implements robust authentication mechanisms to verify user identity and authorize specific operations. Users generate API keys through exchange interfaces, receiving a public key identifier and a private secret key used for cryptographic signing. When making authenticated requests, applications include the API key and generate HMAC (Hash-based Message Authentication Code) signatures by hashing request parameters with the secret key, proving they possess the private credential without transmitting it directly. Exchanges verify these signatures server-side, rejecting any requests with invalid or missing authentication. Modern platforms implement granular permission controls allowing users to create API keys with limited scopes such as read-only access for portfolio tracking, trading permissions without withdrawal capabilities, or specific trading pair restrictions. This permission architecture follows security best practices of least privilege, ensuring that even if API keys are compromised, potential damage remains limited to explicitly granted capabilities.

Rate Limiting & Throttling

API integration in exchange platforms incorporates rate limiting and throttling mechanisms that protect backend infrastructure from overload while ensuring fair resource distribution. Exchanges define maximum request rates typically measured in requests per second or per minute for different API endpoints, with more restrictive limits on resource-intensive operations like order placement compared to simple data retrieval. When applications exceed these limits, APIs return specific error codes indicating rate limit violations, requiring applications to implement exponential backoff strategies that progressively slow request rates. Sophisticated exchanges provide tiered rate limits based on account levels, offering higher limits to institutional clients, market makers, or premium subscribers who generate substantial trading volume. Rate limiting also prevents denial-of-service attacks where malicious actors might attempt to overwhelm exchange servers. Well-designed APIs communicate current rate limit status through response headers showing remaining requests and reset timestamps, enabling applications to proactively manage request pacing and avoid interruptions.

Error Handling & Monitoring

Robust exchange API integration implements comprehensive error handling that clearly communicates issues and enables rapid troubleshooting. APIs return standardized HTTP status codes indicating request outcomes such as success, authentication failures, validation errors, rate limit violations, server errors, and service unavailability. Detailed error messages provide specific information about what went wrong, including invalid parameters, insufficient balances, unavailable trading pairs, or temporary service disruptions. Well-documented exchanges maintain extensive error code references that developers use to implement appropriate handling logic. Monitoring systems track API performance metrics including response times, error rates, endpoint availability, and throughput capacity, alerting engineering teams to degradation before it impacts users. Advanced platforms provide status pages showing real-time API health, scheduled maintenance windows, and historical uptime statistics. Application developers implement their own monitoring of API interactions, logging requests and responses, tracking success rates, and alerting on unexpected patterns that might indicate integration issues or exchange problems requiring immediate attention.

How APIs Enable Advanced Trading Platform Capabilities

API integration for trading platforms unlocks sophisticated capabilities that transform basic exchange access into professional-grade trading infrastructure supporting complex strategies, automated execution, and institutional-level operations that define modern cryptocurrency markets.

Automated & Algorithmic Trading

Trading platform API integration provides the foundation for automated and algorithmic trading systems that execute strategies based on mathematical models, technical indicators, and predefined rules without human intervention. Algorithms continuously monitor market conditions through real-time API data feeds, analyzing price movements, volume patterns, order book imbalances, and other signals to identify trading opportunities. When conditions align with strategy parameters, systems automatically place orders through API endpoints with precise timing that captures favorable prices before market conditions change. Advanced algorithms implement sophisticated logic including mean reversion strategies that profit from price normalization, momentum strategies that follow strong price trends, market making strategies that provide liquidity while capturing bid-ask spreads, and statistical arbitrage that exploits temporary price inefficiencies. APIs enable these systems to operate continuously without fatigue, execute trades in milliseconds, and manage multiple strategies simultaneously across different trading pairs and market conditions.

Trading Bots & Strategy Execution

APIs in exchange platforms power trading bots that range from simple automation tools to sophisticated artificial intelligence systems. Basic bots use APIs to implement dollar-cost averaging strategies that purchase fixed amounts at regular intervals, rebalancing algorithms that maintain target portfolio allocations, and stop-loss automation that exits positions when losses reach predefined thresholds. Advanced bots incorporate machine learning models that analyze historical data patterns, sentiment analysis from news and social media, and complex technical indicators to generate trading signals. Through continuous API connectivity, bots monitor positions, adjust orders based on changing conditions, and execute complete trading workflows including entry, position management, and exit strategies. The 24/7 nature of cryptocurrency markets makes bot automation particularly valuable, as human traders cannot continuously monitor positions, but API-connected bots maintain vigilance regardless of time zones or market hours.

Arbitrage Trading Across Exchanges

Trading platform API integration enables arbitrage strategies that exploit price differences across multiple exchanges, generating profit from temporary market inefficiencies. Arbitrage systems simultaneously monitor pricing on multiple platforms through API connections, identifying opportunities where the same asset trades at different prices. When profitable spreads appear, systems quickly execute coordinated buy and sell orders across exchanges, purchasing where prices are low and selling where prices are high, capturing the difference as profit. APIs enable the speed essential for arbitrage success, as opportunities typically exist for only seconds or minutes before market forces equalize prices. Sophisticated arbitrage systems account for trading fees, withdrawal costs, and transfer times when calculating profitability. Triangular arbitrage strategies use APIs to execute multi-leg trades within a single exchange, exploiting price inefficiencies between three trading pairs to generate returns without requiring fund transfers between platforms.

Multi-Exchange Order Routing

Advanced trading infrastructure leverages APIs to implement smart order routing systems that optimize execution across multiple exchanges simultaneously. When traders place large orders that might cause significant slippage on a single exchange, routing algorithms use APIs to split orders across multiple venues, executing portions on different platforms to achieve better average prices. Systems analyze available liquidity, current order book depth, historical execution quality, and real-time fees across connected exchanges, dynamically determining optimal execution paths. APIs enable routing systems to place orders simultaneously, monitor execution progress, and adjust remaining order quantities based on partial fills. This multi-exchange capability particularly benefits institutional traders and large position managers who require execution quality that exceeds what any single exchange can provide, using API integration to create virtual liquidity pools that aggregate available trading opportunities across the fragmented cryptocurrency exchange landscape.

Secure API Integration for Crypto Exchanges

Implementing secure API integration for crypto exchanges requires comprehensive security measures that protect user assets, prevent unauthorized access, and maintain system integrity against evolving threats in an environment where transactions are irreversible and funds can be transferred globally within minutes.

API Security Risks

API integration in exchange platforms faces numerous security threats that demand constant vigilance and proactive protection. Compromised API keys represent the most direct threat, potentially granting attackers complete control over accounts including the ability to execute trades, withdraw funds, and manipulate positions. Phishing attacks target users to obtain API credentials through fake exchange websites or malicious applications. Man-in-the-middle attacks attempt to intercept API communications to steal authentication data or modify request parameters. Replay attacks capture legitimate API requests and retransmit them to duplicate transactions or manipulate account states. Insufficient rate limiting enables brute-force attacks against authentication systems or denial-of-service campaigns that overwhelm exchange infrastructure. API key leakage through code repositories, insecure storage in applications, or inadequate access controls exposes credentials to public discovery. Additionally, vulnerabilities in API implementation itself, including injection attacks, parameter tampering, and improper error handling, create exploitation opportunities for sophisticated attackers seeking unauthorized access or system disruption.

Best Practices for Secure Integration

Implementing secure API integration for crypto exchanges demands multiple layers of protection working in concert to create defense in depth. IP whitelisting restricts API access to specific, pre-approved IP addresses, ensuring that even if API keys are compromised, attackers cannot use them from unauthorized locations. This protection particularly benefits institutional traders and algorithmic systems operating from fixed infrastructure. HMAC (Hash-based Message Authentication Code) authentication and request signing ensures that API requests cannot be forged or modified in transit, with each request including a cryptographic signature generated using the secret key that exchanges verify server-side. Implementing TLS/SSL encryption for all API communications prevents eavesdropping and man-in-the-middle attacks by ensuring that data remains encrypted during transmission.

Two-factor authentication requirements for generating new API keys or modifying key permissions add an extra security layer that protects against account compromise. Granular permission controls enable users to create API keys with limited scopes, such as read-only access for portfolio tracking applications, trading permissions without withdrawal capabilities, or restrictions to specific trading pairs. This principle of least privilege ensures that compromised keys provide minimal access to attackers. Request timestamp validation and nonce implementation prevent replay attacks by rejecting requests that fall outside acceptable time windows or reuse previously seen unique identifiers. Regular API key rotation policies require periodic generation of new keys and retirement of old credentials, limiting the window of vulnerability from undetected compromises.

Comprehensive logging and monitoring systems track all API activities, flagging suspicious patterns such as access from unusual locations, abnormally high request rates, failed authentication attempts, or unexpected withdrawal requests. Automated alerts notify users and security teams of potential compromises, enabling rapid response before significant damage occurs. Exchanges should conduct regular security audits, penetration testing, and maintain bug bounty programs that incentivize security researchers to identify and report vulnerabilities before malicious actors can exploit them. Clear documentation and user education about API security best practices, including secure key storage, avoiding key inclusion in code repositories, and recognizing phishing attempts, creates informed users who implement proper security measures in their own applications and systems.

Scalable Exchange Platform Using APIs

Building a scalable exchange platform using APIs requires architectural decisions and infrastructure design that enable platforms to grow from serving thousands of users to millions while maintaining performance, reliability, and responsiveness during both normal operations and extreme market volatility.

Handling High Trading Volumes

The importance of APIs in crypto exchanges becomes evident when platforms must process millions of orders daily while providing real-time market data to countless connected applications. Scalable API architectures separate concerns through microservices design where different exchange functions operate as independent services that can scale horizontally based on demand. The order matching engine operates independently from market data distribution, which functions separately from account management systems, allowing each component to scale according to its specific load patterns. During high-volume trading periods, exchanges can dynamically provision additional API servers to handle increased request loads without impacting core trading engine performance. Caching layers reduce database queries by storing frequently accessed data such as current prices, order book snapshots, and account balances in fast memory stores, dramatically reducing response times and backend load for read operations.

API Scalability During Market Volatility

Cryptocurrency markets experience extreme volatility where prices can swing dramatically within minutes, triggering massive surges in trading activity as participants rush to adjust positions. APIs in exchange platforms must maintain functionality during these peak periods when request volumes can increase tenfold or more compared to normal conditions. Scalable architectures implement intelligent rate limiting that adjusts dynamically based on system capacity, temporarily reducing per-user limits during overload while maintaining overall system stability. Priority queueing systems ensure that critical operations like order cancellations and position liquidations process even when less critical requests face delays. Degradation strategies allow exchanges to temporarily disable resource-intensive features like detailed historical data retrieval while maintaining core trading functionality, ensuring that users can always execute trades even if ancillary features become temporarily unavailable. Auto-scaling infrastructure automatically provisions additional computing resources when monitoring systems detect rising load, maintaining response times and availability without manual intervention.

Load Balancing & Microservices Architecture

Modern scalable exchange platforms using APIs implement sophisticated load balancing that distributes incoming requests across multiple server instances, preventing any single server from becoming overwhelmed while maximizing resource utilization. Load balancers monitor server health, automatically removing failed instances from rotation and directing traffic only to healthy servers that can process requests efficiently. Geographic distribution places API servers in multiple regions worldwide, routing users to nearest locations that minimize network latency and improve response times. Microservices architecture breaks monolithic exchange platforms into discrete services that communicate through internal APIs, enabling independent deployment, scaling, and failure isolation. When market data services experience high load, they can scale independently without requiring additional capacity for order processing services that might be operating normally. This architectural approach also enables rolling updates where services deploy new versions gradually, maintaining overall system availability while implementing improvements. Container orchestration platforms automate deployment, scaling, and management of microservices, dynamically adjusting resource allocation based on real-time demand patterns and maintaining high availability through automated failover and recovery mechanisms.

Business Benefits of API Integration in Crypto Exchanges

The benefits of API integration in exchanges extend far beyond technical capabilities, creating substantial competitive advantages and unlocking diverse revenue opportunities that determine long-term platform success and market positioning in an increasingly competitive landscape.

Faster Go-to-Market

Robust API for crypto exchanges dramatically accelerates development timelines by enabling rapid feature deployment and market expansion without requiring extensive infrastructure rebuilding. When exchanges need to add new trading pairs, they simply configure the matching engine and expose new endpoints through existing API frameworks rather than rebuilding entire trading interfaces. Third-party developers build applications, tools, and services on top of exchange APIs, creating an ecosystem that extends platform capabilities without requiring direct investment from exchange operators. This developer ecosystem drives organic growth as innovative applications attract new users who then become exchange customers. Exchanges can quickly enter new geographic markets by partnering with local payment providers and regulatory services through API integrations, connecting compliant on-ramps and off-ramps without building region-specific infrastructure from scratch. White-label solutions leverage APIs to enable partner companies to offer cryptocurrency trading under their own brands, expanding market reach through distribution partnerships that would take years to build directly.

Enhanced User Experience

The importance of APIs in crypto exchanges manifests in dramatically improved user experiences that differentiate leading platforms from competitors. APIs enable professional traders to use sophisticated trading terminals like TradingView, Coinigy, or custom-built interfaces that provide superior charting, analysis, and execution capabilities compared to basic web interfaces. Portfolio management applications aggregate holdings across multiple exchanges through API connections, providing unified views of total positions, performance tracking, and tax reporting that would be impossible with manual tracking. Mobile applications leverage APIs to provide full trading functionality with responsive interfaces optimized for different screen sizes and use cases, ensuring traders remain connected to markets regardless of location or device. Real-time notifications delivered through APIs keep users informed of important events like filled orders, price alerts, margin calls, and security events, enabling rapid responses to time-sensitive situations. The flexibility to access exchange functionality through diverse interfaces, custom tools, and integrated workflows creates user experiences tailored to individual needs rather than forcing everyone through identical web interfaces designed for broad audiences.

Institutional & B2B Enablement

Professional-grade APIs in exchange platforms unlock institutional and business-to-business opportunities that generate substantially higher revenue per user compared to retail traders. Institutional traders including hedge funds, proprietary trading firms, and market makers require robust API access to implement sophisticated strategies, manage large positions, and integrate exchanges into existing trading infrastructure that typically spans multiple asset classes and venues. These institutions generate enormous trading volumes, paying significant fees while demanding minimal customer support due to their technical sophistication. Prime brokerage services leverage APIs to provide institutional clients with aggregated liquidity, margin financing, and unified reporting across multiple exchanges, creating high-value service offerings. OTC (over-the-counter) desks use APIs to facilitate large block trades that minimize market impact, serving institutional clients who cannot execute sizable positions through regular order books without causing adverse price movements. Payment processors, financial applications, and fintech platforms integrate exchange APIs to embed cryptocurrency trading capabilities within their existing products, creating distribution channels that acquire users at scale without direct marketing costs.

Revenue Growth Through API Monetization

Forward-thinking exchanges recognize that APIs themselves represent valuable assets that can generate direct revenue beyond trading fees. Tiered API access models charge premium fees for higher rate limits, allowing high-frequency traders and institutional clients to execute strategies requiring thousands of requests per minute while casual users access basic functionality at no additional cost. Historical data feeds delivered through APIs provide valuable market information to researchers, analysts, and data companies willing to pay subscription fees for comprehensive trading history, order book snapshots, and market statistics. Market data terminals and financial information services license exchange APIs to deliver cryptocurrency prices to their user bases, paying per-request fees or flat licensing charges. Whitelabel API access enables other companies to build cryptocurrency trading into their platforms while leveraging established exchange infrastructure, with exchanges earning both integration fees and ongoing revenue shares from generated trading volumes. These monetization strategies transform APIs from purely technical interfaces into profit centers that contribute directly to bottom-line results while simultaneously expanding platform reach and building broader cryptocurrency adoption.

Real-World Use Cases of Exchange API Integration

Examining real-world implementations demonstrates how leading platforms leverage exchange API integration to build competitive advantages, serve diverse user segments, and enable innovative applications that define the cryptocurrency trading landscape.

Binance API Ecosystem

Binance has built one of the most comprehensive API ecosystems in cryptocurrency trading, offering multiple API products that serve different use cases. Their REST API provides access to spot trading, futures trading, margin trading, and savings products, enabling developers to build complete trading platforms on Binance infrastructure. WebSocket streams deliver real-time market data for all trading pairs with multiple subscription options including individual ticker updates, aggregated trade streams, order book snapshots, and user account updates. Binance’s API ecosystem powers thousands of third-party applications including trading bots, portfolio trackers, mobile trading apps, and institutional trading terminals. The platform provides comprehensive documentation, code examples in multiple programming languages, and active developer communities that lower integration barriers. High-volume traders access dedicated API endpoints with increased rate limits and faster execution, while institutional clients receive premium support and custom integration assistance. This ecosystem approach transforms Binance from a standalone exchange into a platform that enables an entire industry of applications, driving network effects where more developers attract more users who in turn attract more developers.

Coinbase Exchange APIs

Coinbase offers distinct API products targeting different customer segments, demonstrating how exchanges can build diverse offerings on API foundations. The Coinbase Exchange API (formerly GDAX) serves professional traders with full order book access, advanced order types, and institutional-grade execution capabilities. Coinbase Pro APIs enable algorithmic trading, market making, and sophisticated portfolio management through comprehensive REST and WebSocket interfaces. Separately, the Coinbase Commerce API allows merchants to accept cryptocurrency payments, integrating digital currency acceptance into e-commerce platforms without requiring deep cryptocurrency expertise. Coinbase Custody APIs provide institutional clients with programmatic access to secure asset storage, enabling fund managers and institutional investors to integrate cryptocurrency holdings into existing portfolio management systems. The Coinbase Prime platform offers APIs specifically designed for institutional trading with features like multi-user permissions, compliance tools, and consolidated reporting. This segmented approach recognizes that retail users, active traders, merchants, and institutions have fundamentally different needs, building specialized APIs that optimize for each use case rather than forcing everyone through identical interfaces.

Multi-Liquidity Trading Platforms

Specialized platforms leverage APIs from multiple exchanges to aggregate liquidity and provide superior execution quality compared to trading on any single venue. These platforms connect to dozens of exchanges simultaneously through their respective APIs, maintaining real-time order book data and monitoring available liquidity across the entire market. When users place orders, smart routing algorithms analyze all connected exchanges, comparing prices, available volumes, and estimated execution costs to determine optimal trading paths. Large orders automatically split across multiple exchanges, executing portions on each venue at the best available prices to minimize slippage and achieve better average fills than concentrated execution. Arbitrage detection systems identify price discrepancies across connected exchanges, automatically executing profitable trades that capitalize on temporary inefficiencies. For institutional clients requiring block trades, these platforms find sufficient liquidity across multiple venues that no single exchange could provide, enabling position entry and exit at scales that would otherwise require days of careful execution to avoid market impact.

Institutional Trading Desks

Professional trading operations build sophisticated infrastructure on top of exchange APIs to serve institutional clients requiring capabilities far beyond standard retail trading interfaces. These desks integrate APIs from major exchanges into unified trading platforms that provide consolidated order books, cross-exchange position management, and institutional-grade risk controls. Traders simultaneously monitor and execute across multiple venues from single interfaces, with systems automatically routing orders to optimal exchanges based on liquidity, pricing, and execution quality. Algorithmic execution strategies like TWAP (Time-Weighted Average Price) and VWAP (Volume-Weighted Average Price) spread large orders over time, executing small portions gradually to minimize market impact while still completing positions within required timeframes. Margin and lending platforms use APIs to provide institutional leverage, automatically managing collateral, calculating margin requirements, and executing liquidations when positions approach risk limits. Settlement and reporting systems aggregate activity across all connected exchanges, generating comprehensive records for compliance, accounting, and performance analysis that meet institutional governance requirements impossible to satisfy with retail exchange interfaces.

Challenges in API Integration & How to Overcome Them

Despite the substantial benefits, API integration in exchange platforms faces significant challenges that developers and platform operators must address to ensure reliable, performant, and secure implementations.

API Downtime & Service Interruptions

Exchange APIs occasionally experience downtime due to maintenance, infrastructure failures, DDoS attacks, or overwhelming traffic during extreme market volatility. These interruptions can disrupt trading operations, prevent position management, and cause financial losses for users unable to execute intended strategies. Overcoming this challenge requires implementing robust error handling that gracefully manages temporary unavailability, automatic retry logic with exponential backoff to avoid overwhelming recovering systems, and fallback mechanisms that redirect operations to alternative exchanges when primary venues become unavailable. Applications should maintain local state and queue pending operations during outages, automatically resuming when connectivity restores. Exchanges improve reliability through redundant infrastructure, geographic distribution, and comprehensive monitoring that detects issues before they impact users.

Data Inconsistency & Synchronization

Maintaining consistent data across distributed systems presents ongoing challenges, particularly when applications aggregate information from multiple exchanges or when high-frequency trading requires absolute precision. Order book data from different sources may show slight variations due to network latency, update frequencies, or local processing delays. Account balances might temporarily appear inconsistent as deposits and withdrawals process through blockchain confirmations. Addressing these challenges requires implementing data validation that cross-references information from multiple sources, timestamping all data to understand freshness and potential staleness, and building reconciliation processes that periodically verify local states against authoritative exchange records. Applications should treat real-time data streams as provisional, confirming critical information through direct API queries before making important trading decisions. Understanding and documenting expected latencies helps set realistic expectations about data freshness and execution timing.

Rate Limits & Request Management

API rate limits constrain how quickly applications can make requests, potentially limiting functionality for high-frequency strategies or applications monitoring many trading pairs simultaneously. Exceeding limits results in temporary blocks that interrupt operations and delay time-sensitive actions. Overcoming rate limit challenges requires implementing sophisticated request management that tracks consumption rates, prioritizes critical operations, and optimally utilizes available request capacity. Applications should cache data locally when possible, reducing unnecessary API calls for information that changes infrequently. Batch operations that retrieve multiple pieces of information in single requests maximize efficiency. WebSocket connections for real-time data eliminate the need for repeated polling that quickly exhausts rate limits. Working with exchanges to obtain higher limits for institutional accounts or high-volume users provides additional capacity when standard limits prove insufficient for legitimate use cases.

Compliance & Regulatory Challenges

Cryptocurrency regulations vary significantly across jurisdictions, with exchanges facing different requirements regarding user verification, transaction reporting, geographic restrictions, and operational licensing. APIs must enforce these requirements while maintaining seamless user experiences. Implementing geolocation detection that restricts access from prohibited jurisdictions, KYC (Know Your Customer) verification workflows that gate account creation and trading capabilities, transaction monitoring that flags suspicious activities, and comprehensive audit logging that satisfies regulatory reporting requirements all add complexity to API implementations. Exchanges address these challenges through compliance-focused API design that builds regulatory requirements directly into platform architecture rather than treating them as afterthoughts. Clear documentation communicating compliance requirements, restricted features, and geographic availability helps developers build compliant applications. Partnering with legal experts and regulatory consultants ensures that API functionality meets evolving requirements across different markets.

Future of Crypto Exchange APIs

The evolution of crypto exchange APIs will reshape trading infrastructure over the coming years, driven by technological advances, changing market demands, and the maturation of cryptocurrency as an asset class that increasingly integrates with traditional finance.

WebSocket Dominance & Real-Time Everything

WebSocket APIs will become the primary communication protocol for exchange interactions as the industry moves beyond request-response patterns toward continuous real-time data streams. Rather than polling for updates, applications will maintain persistent connections receiving instant notifications of every relevant event including order fills, balance changes, margin updates, and system alerts. Advanced WebSocket implementations will support bidirectional communication where exchanges can push data while simultaneously receiving commands, enabling true real-time trading where latency measures in single-digit milliseconds. Exchanges will offer increasingly granular subscription options allowing applications to receive exactly the data they need without overwhelming bandwidth or processing capacity with unnecessary information. This WebSocket dominance will enable new application categories including real-time collaborative trading, live strategy competitions, and social trading platforms where users observe and replicate each other’s trades with minimal delay.

REST API vs WebSocket API Comparison

| Feature | REST API | WebSocket API |

|---|---|---|

| Connection Type | Stateless request-response | Persistent bidirectional connection |

| Data Flow | Pull-based (client requests) | Push-based (server sends updates) |

| Latency | Higher (new connection each time) | Lower (persistent connection) |

| Best Use Cases | Order placement, balance checks, historical data | Live prices, order book updates, trade alerts |

| Bandwidth Efficiency | Lower (overhead per request) | Higher (single connection) |

| Implementation Complexity | Simple | Moderate (connection management) |

| Rate Limiting | Per request/minute | Per connection/subscription |

AI-Driven API Trading

Artificial intelligence integration will transform APIs from passive data interfaces into intelligent trading assistants that provide actionable insights and automated decision support. Machine learning models trained on historical market data will generate predictive signals delivered directly through API responses, helping traders anticipate price movements and volatility changes. Natural language interfaces will allow traders to execute complex strategies through conversational commands rather than intricate API parameters, with AI systems translating intent into appropriate API calls. Risk management APIs will leverage AI to provide real-time portfolio analysis, suggesting position adjustments based on market conditions, correlation patterns, and individual risk tolerance. Sentiment analysis incorporating news, social media, and order flow data will feed into API-delivered market intelligence that contextualizes price movements and identifies emerging trends. Exchanges will offer AI-as-a-service through APIs, enabling smaller traders and developers to access sophisticated analytical capabilities without building expensive infrastructure.

Cross-Chain & Decentralized APIs

The future will bring APIs that seamlessly bridge centralized exchanges with decentralized finance (DeFi) protocols, creating unified liquidity access across different blockchain ecosystems. Cross-chain APIs will enable trading assets across multiple blockchains without manual bridging, automatically routing orders through optimal paths that might span centralized exchanges, decentralized exchanges, and cross-chain bridges. Decentralized exchange APIs will mature to offer functionality comparable to centralized platforms while maintaining non-custodial security, with standardized protocols enabling applications to integrate multiple DEXs through unified interfaces. Smart contract APIs will allow programmatic interaction with DeFi protocols for lending, staking, and liquidity provision, bringing sophisticated yield strategies to broader audiences. Interoperability standards will emerge enabling cross-platform trading where single API calls execute complex strategies spanning centralized and decentralized venues, optimizing for price, liquidity, and gas costs across the entire crypto ecosystem.

API Standardization & Universal Protocols

Industry standardization efforts will create universal API protocols that allow applications to integrate multiple exchanges through consistent interfaces rather than building custom implementations for each platform. These standards will define common data formats, authentication methods, and operational patterns that all compliant exchanges support, dramatically reducing integration complexity. Developers will build applications once that work across dozens of exchanges without exchange-specific code, while exchanges adopting standards will benefit from easier integration into existing tools and platforms. Financial Information eXchange (FIX) protocol adaptations for cryptocurrency trading will enable institutional infrastructure to connect with crypto markets using familiar interfaces, accelerating institutional adoption. Open-source API gateways will provide standardized layers that translate between different exchange implementations and common protocols, offering immediate standardization benefits even before universal adoption. This standardization will commoditize basic API functionality while encouraging exchanges to differentiate through advanced features, execution quality, and value-added services rather than simply providing market access.

Conclusion

Crypto exchange APIs represent far more than technical interfaces, they constitute the fundamental growth engine that determines platform scalability, competitive positioning, and long-term viability in the rapidly evolving cryptocurrency market. Exchanges with robust, well-documented, and performant APIs attract professional traders, institutional clients, and third-party developers who collectively generate the trading volume, liquidity, and ecosystem vitality that define market-leading platforms.

The importance of APIs in crypto exchanges manifests across every aspect of platform success. APIs enable the automated trading systems and algorithmic strategies that now dominate cryptocurrency markets, accounting for the majority of trading volume on major exchanges. They power the portfolio management tools, analytical platforms, and mobile applications that provide superior user experiences compared to basic web interfaces. APIs facilitate institutional adoption by integrating cryptocurrency trading into existing financial infrastructure, bringing professional capital and sophisticated strategies that mature markets and improve price discovery.

Looking forward, API integration in exchange platforms will only grow in importance as markets mature and user expectations evolve. The exchanges that invest in API excellence, building comprehensive documentation, maintaining high availability, implementing strong security, and continuously expanding functionality will capture disproportionate market share. APIs transform exchanges from isolated trading venues into platforms that enable entire ecosystems of applications, creating network effects where each new tool and service attracts more users who in turn attract more developers.

For exchange operators, prioritizing API development represents essential strategic investment rather than optional technical enhancement. For developers and traders, understanding API capabilities and limitations determines what trading strategies become possible and which platforms can support sophisticated requirements. As cryptocurrency trading continues its evolution toward mainstream financial acceptance, APIs will remain the technological foundation enabling innovation, scaling operations, and building the infrastructure that supports global digital asset markets serving millions of users trading billions of dollars daily. The exchanges that recognize APIs as their primary growth engine, investing accordingly in technology, documentation, and developer relations, position themselves to lead the next generation of cryptocurrency trading platforms.

Frequently Asked Questions

Crypto exchange APIs are tools that allow software applications to communicate with cryptocurrency trading platforms, enabling automated access to market data, order execution, and portfolio management. By understanding how APIs work in exchange platforms, businesses can integrate trading functionalities directly into their applications, offer users real-time prices, and automate trading strategies. For crypto exchange operators, implementing robust APIs can enhance platform functionality, improve operational efficiency, and create new revenue streams through API subscriptions or premium services.

The importance of APIs in crypto exchanges lies in their ability to connect internal systems with external services seamlessly. APIs play a critical role in exchange platforms by enabling real-time market updates, automated order execution, and integration with wallets, liquidity providers, and analytics tools. For businesses, leveraging APIs means faster innovation, improved user experience, and the ability to scale operations without major infrastructure changes, giving a competitive advantage in the rapidly evolving crypto ecosystem.

Crypto exchanges primarily use public APIs for fetching market data like prices and trading volumes, and private APIs for account management, order execution, and portfolio tracking. Understanding APIs in exchange platforms allows developers to optimize exchange API integration for secure and seamless trading. Choosing the right API type ensures that your platform can provide both transparency to traders and secure access to sensitive account functionalities, essential for commercial adoption and compliance.

Effective API integration in exchange platforms directly enhances trading performance by providing real-time data, faster order execution, and automated portfolio management. With trading platform API integration, exchanges can offer lower latency, better liquidity utilization, and smoother user experiences. From a business perspective, API integration reduces operational bottlenecks, allows for advanced trading features, and enables platforms to handle higher trading volumes efficiently, boosting revenue potential.

Implementing API for crypto exchanges brings multiple business advantages, including faster go-to-market for new services, improved customer retention, and monetization opportunities through API access fees. Benefits of API integration in exchanges also include streamlined operations, enhanced scalability, and the ability to offer institutional-grade tools for algorithmic trading and portfolio management. APIs transform a crypto exchange from a simple trading platform into a comprehensive financial ecosystem.

Secure API integration for crypto exchanges is essential to protect sensitive user data and prevent unauthorized access. Implementing measures like HMAC encryption, IP whitelisting, two-factor authentication, and fine-grained permission controls ensures secure API integration in exchange platforms. For businesses, prioritizing security builds trust with traders, reduces compliance risks, and strengthens the platform’s reputation in an increasingly competitive market.

Yes, scalable exchange platform using APIs allows platforms to handle high trading volumes and sudden market volatility without performance degradation. Importance of APIs in crypto exchanges lies in enabling modular architectures, microservices, and automated load balancing. This ensures that as your user base grows, the platform remains responsive and reliable, creating a strong foundation for commercial growth and institutional adoption.

Through API integration for trading platforms, exchanges can connect trading bots and automated strategies directly to their infrastructure. Trading platform API integration enables algorithmic trading to access real-time market data, place orders instantly, and execute complex strategies across multiple markets. For businesses, offering this capability enhances the platform’s appeal to professional traders and institutional clients, providing additional revenue through premium API services or trading tool subscriptions.

Exchange API integration faces challenges such as rate limits, data inconsistency, downtime, and compliance requirements. Implementing secure API integration for crypto exchanges helps mitigate these risks through robust error handling, throttling, and monitoring. For commercial platforms, overcoming these challenges ensures reliable services for traders, reduces operational risks, and supports regulatory compliance, which is vital for attracting institutional clients.

Crypto exchange APIs provide continuous access to market feeds, order books, and trading volumes, ensuring traders have the most up-to-date information. Their role of APIs in exchanges includes aggregating data from multiple sources, enabling real-time analytics, and triggering automated trading actions. Platforms that effectively implement these APIs can offer a competitive advantage by delivering faster, more accurate trading insights to users, which drives higher engagement and trading activity.

Role of APIs in exchange platforms is critical for aggregating liquidity from multiple sources, providing better pricing and minimizing slippage for traders. Exchange API integration enables seamless connection to several exchanges or liquidity providers, automatically routing orders to the best available market. For businesses, this capability improves user satisfaction, increases trade volume, and strengthens the platform’s commercial value in competitive trading environments.

Selecting the right API for crypto exchanges requires evaluating factors such as latency, scalability, security, and feature set. API integration in exchange platforms should align with business goals, whether targeting retail traders, institutions, or automated trading ecosystems. A well-planned API strategy enables smooth integration with third-party tools, supports high-volume trading, and creates new monetization channels, ensuring that the platform remains future-ready and commercially competitive.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.