Key Takeaways

- OTC crypto exchange platforms enable large cryptocurrency trades directly between parties without using public order books, preventing market impact and price slippage for institutional investors.

- Key features of OTC exchanges include secure and private transactions, high liquidity solutions, personalized trading support, and transparent pricing mechanisms for wholesale crypto trading.

- OTC trading benefits include enhanced security for large transactions, reduced market volatility impact, faster settlement, and access to exclusive trading opportunities unavailable on traditional exchanges.

- How OTC crypto trading works involves registration, KYC verification, trade negotiation, price matching, and secure settlement, typically facilitated by dedicated OTC desks and brokers.

- Institutional crypto trading through OTC platforms provides personalized service, competitive pricing for high volumes, and compliance support that standard exchanges cannot match.

- Crypto liquidity solutions through OTC desks aggregate supply across multiple sources, ensuring best execution for trades that would fragment or fail on traditional order book exchanges.

- Secure OTC transactions require platforms with robust security features, regulatory compliance, established reputation, and transparent fee structures for trustworthy large-value trading.

- Choosing the right OTC crypto platform involves evaluating security measures, liquidity depth, reputation, fees, and settlement capabilities aligned with specific trading requirements.

The cryptocurrency market has matured significantly, and with this maturity comes the need for sophisticated trading infrastructure that serves institutional participants and high-volume traders. OTC crypto exchange platforms fill this critical gap, enabling large transactions that would be impossible or highly disadvantageous on traditional exchanges. Understanding how these platforms work, their key features, and their benefits helps traders make informed decisions about their cryptocurrency trading strategies.

Introduction to OTC Crypto Exchange

Introduction to OTC crypto exchange begins with understanding the unique challenges that large-volume cryptocurrency traders face. Traditional exchanges work well for retail trading, but attempting to execute significant orders through public order books creates substantial problems including price slippage, market impact, and incomplete fills. OTC trading platforms emerged to solve these challenges, providing infrastructure specifically designed for wholesale cryptocurrency transactions.

What is OTC Cryptocurrency Trading?

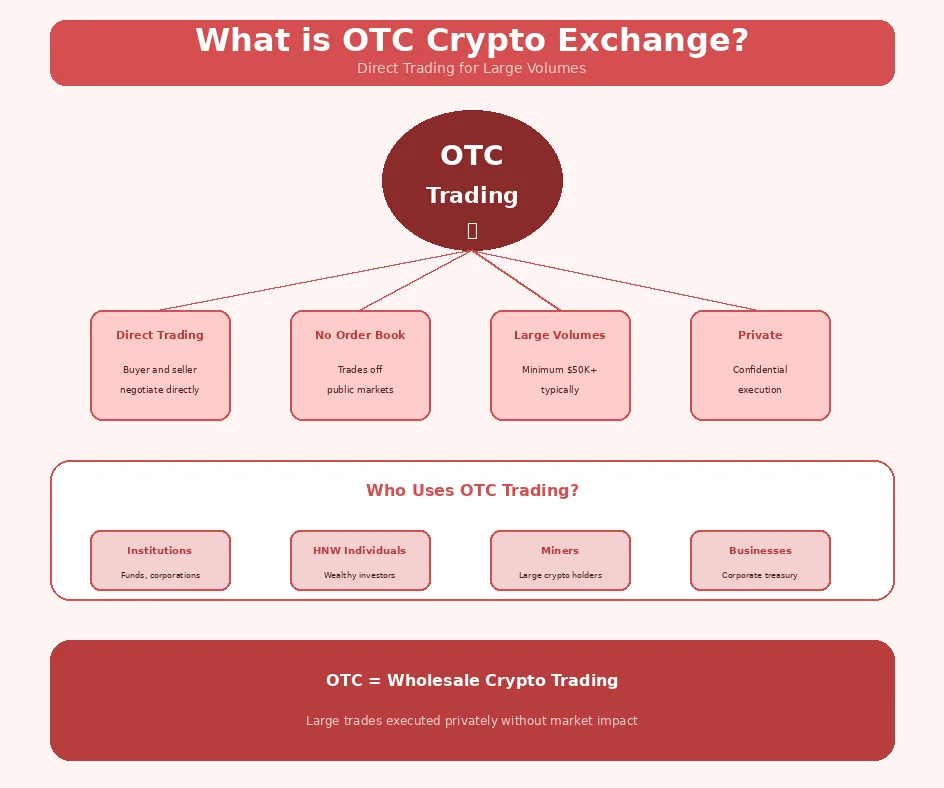

OTC cryptocurrency trading refers to the direct exchange of digital assets between two parties without using traditional exchange order books. Over-the-counter crypto trading involves negotiation between buyers and sellers, typically facilitated by OTC desks that match counterparties and provide trading infrastructure. This method allows parties to agree on specific prices, quantities, and settlement terms before execution.

The OTC market serves participants needing to trade volumes too large for standard exchanges. When someone wants to buy or sell millions of dollars worth of cryptocurrency, doing so through exchange order books would move prices significantly. OTC trading platforms provide alternatives that execute these trades at agreed prices without the market impact that would otherwise occur.

Difference Between OTC and Traditional Crypto Exchanges

The difference between OTC and traditional crypto exchanges centers on how trades are executed and their suitability for different trading needs. Traditional exchanges use order books where buy and sell orders are publicly visible and matched automatically. OTC trading platform services operate differently, facilitating direct negotiation between parties for customized transactions that never appear on public order books.

Traditional exchanges excel at providing transparent pricing and efficient execution for standard-sized trades. However, they struggle with large orders that would consume multiple price levels, causing slippage. OTC platforms shine precisely where exchanges fail, handling large volumes with price certainty and discretion. Understanding comprehensive approaches to building cryptocurrency trading platforms reveals why different market segments require different solutions.

Why OTC Trading is Important for Institutional Investors

Institutional crypto trading through OTC platforms is important because institutions face unique requirements that retail-focused exchanges cannot address. Investment funds, corporations, and high-net-worth individuals need to execute large positions without revealing their trading intentions to the market. OTC desks provide the privacy, service quality, and execution capabilities these participants require.

Institutional investors also require compliance support, secure custody integration, and personalized service that standard exchanges rarely provide. OTC platforms offer dedicated account managers, customized reporting, and regulatory compliance assistance that institutions need for their internal governance and external reporting requirements.

Market Principle: OTC trading represents a significant portion of cryptocurrency market volume, with estimates suggesting OTC trades account for two to three times the volume visible on exchanges. This hidden liquidity is essential for market function.

Key Features of an OTC Crypto Exchange

Key features of OTC exchanges distinguish these platforms from standard cryptocurrency trading venues. These features address the specific needs of large-volume traders, providing capabilities that make wholesale cryptocurrency trading practical, secure, and efficient. Understanding these features helps traders evaluate platforms and select services aligned with their requirements.

Secure and Private Transactions

Secure and private transactions form the foundation of quality OTC services. Secure OTC transactions protect both the assets being traded and the confidentiality of trading activity. Privacy matters because revealing large trading intentions can disadvantage traders as others front-run or adjust prices based on anticipated market movements.

Security features include secure custody solutions, multi-signature wallets, escrow services during settlement, and comprehensive insurance coverage. Privacy features ensure trading activity remains confidential, with transactions occurring without public visibility that would affect market prices or reveal trading strategies.

High Liquidity Solutions

Crypto liquidity solutions through OTC platforms aggregate supply and demand from multiple sources to fulfill large orders. While exchanges fragment liquidity across order book levels, OTC desks maintain relationships with numerous counterparties, enabling them to source liquidity for even the largest trades. This aggregation capability makes trades possible that would fail or significantly impact prices on traditional exchanges.

High liquidity solutions also mean competitive pricing. By accessing multiple liquidity sources and negotiating optimal terms, OTC desks can often provide better execution than traders would achieve independently, especially for large volumes where exchange slippage would be substantial.

Personalized Trading Support

Personalized trading support differentiates OTC services from automated exchange trading. Dedicated account managers understand client needs, provide market insights, and ensure smooth execution. This human element matters for complex transactions requiring coordination, negotiation, or customization that automated systems cannot provide.

Support extends beyond trade execution to include compliance assistance, reporting customization, and strategic guidance. Building crypto exchanges with institutional-grade support capabilities requires significant investment in personnel and infrastructure.

Large Order Handling Without Market Impact

Large order handling without market impact represents the core value proposition of OTC trading. When trading significant volumes on exchanges, each executed level moves the market, resulting in progressively worse prices. OTC trading eliminates this impact by executing entire orders at agreed prices regardless of size.

This capability matters enormously for large traders. A $10 million Bitcoin purchase on an exchange might move the price by several percent during execution. The same trade through OTC executes at the agreed price without market movement, saving potentially hundreds of thousands of dollars in execution costs.

Transparent Pricing and Settlement

Transparent pricing and settlement ensure traders understand exactly what they pay and receive. Quality OTC platforms provide clear quotes with all costs included, predictable settlement timelines, and detailed transaction documentation. This transparency builds trust and enables accurate trading cost analysis.

OTC vs Exchange Trading Comparison

| Aspect | OTC Trading | Exchange Trading |

|---|---|---|

| Order Size | Large volumes (typically $50K+) | Any size, optimal for smaller trades |

| Market Impact | None (private execution) | Significant for large orders |

| Privacy | High (confidential trades) | Low (public order book) |

| Service | Personalized support | Self-service, automated |

| Price Certainty | Agreed before execution | Variable during execution |

Benefits of OTC Cryptocurrency Trading

OTC trading benefits extend across security, execution quality, and access to opportunities unavailable through standard trading channels. These benefits make OTC trading the preferred method for sophisticated market participants dealing with significant volumes. Understanding these advantages helps traders determine when OTC services align with their needs.

Enhanced Security for Large Transactions

Enhanced security for large transactions through OTC platforms addresses the heightened risks accompanying significant value transfers. Quality OTC services implement institutional-grade security including cold storage custody, multi-signature authorization, escrow arrangements, and comprehensive insurance. These protections exceed what standard exchange accounts typically provide.

Security also encompasses operational procedures that prevent errors, fraud, and unauthorized access. Verification processes, transaction confirmations, and secure communication channels all contribute to protecting large transactions from various risk vectors.

Reduced Market Volatility

Reduced market volatility impact through OTC trading benefits both the trader executing the transaction and the broader market. Large exchange trades create artificial volatility as prices move to accommodate orders. OTC execution prevents this volatility, providing price stability that benefits all market participants.

For traders specifically, avoiding self-induced volatility means better execution prices. The difference between OTC and exchange execution for large orders often represents substantial savings that justify OTC fees many times over.

Faster Settlement and Execution

Faster settlement and execution through established OTC relationships enables time-sensitive trading that exchange processes cannot match. Pre-verified accounts, established credit relationships, and streamlined procedures accelerate transaction completion. For traders needing rapid execution, this speed creates significant value.

Settlement efficiency also reduces counterparty exposure time, decreasing the risk period during which market movements could affect transaction economics. Faster settlement means less time for adverse events to impact trade outcomes.

Access to Exclusive Trading Opportunities

Access to exclusive trading opportunities through OTC networks provides advantages unavailable on public exchanges. Pre-market token access, block trades with specific counterparties, and customized deal structures all become possible through OTC relationships. These opportunities can generate returns impossible to achieve through standard trading channels.

How OTC Crypto Exchanges Work

Understanding how OTC crypto trading works helps participants navigate the process effectively. While procedures vary between platforms, the general workflow follows consistent patterns from initial contact through settlement. Familiarity with these steps enables smoother transactions and better outcomes.

Step-by-Step Process of OTC Crypto Trading

The step-by-step process of OTC crypto trading involves sequential phases that ensure secure, compliant transactions. Each step serves specific purposes in protecting parties, ensuring regulatory compliance, and executing trades efficiently. Understanding how professional crypto exchange services implement trading workflows reveals the infrastructure supporting these processes.

Registration and KYC Verification

Registration and KYC verification establish account relationships and ensure regulatory compliance. New clients provide identity documentation, proof of address, and for institutional clients, business registration and authorization documents. This verification protects all parties and enables the platform to comply with applicable regulations.

Verification typically takes one to three business days depending on documentation completeness and verification requirements. Established clients can proceed to trading once verified, with subsequent transactions not requiring re-verification unless regulations or circumstances change.

Placing a Trade Request

Placing a trade request initiates the OTC trading process. Clients communicate their trading intentions including cryptocurrency, direction (buy or sell), quantity, and any specific requirements. This request goes to the OTC desk, which evaluates liquidity, market conditions, and provides pricing options.

Negotiation and Price Matching

Negotiation and price matching determine the final terms of the transaction. The OTC desk provides quotes based on current market conditions and available liquidity. Clients can accept quoted prices or negotiate terms, with the desk working to find acceptable arrangements. This peer-to-peer crypto trading negotiation process enables customized deals impossible on automated exchanges.

Transaction Settlement and Transfer

Transaction settlement and transfer complete the trading process. Once terms are agreed, parties transfer assets according to settlement procedures. Cryptocurrency transfers to designated wallets while fiat moves through banking channels. Escrow arrangements often protect both parties until all transfers confirm successfully.

OTC Trading Process Lifecycle

| Step | Phase | Activities | Typical Duration |

|---|---|---|---|

| 1 | Registration | Account creation, documentation | 30 minutes |

| 2 | KYC Verification | Identity and compliance checks | 1-3 business days |

| 3 | Trade Request | Submit trading intention | Minutes |

| 4 | Quotation | Receive pricing options | Minutes to hours |

| 5 | Negotiation | Finalize terms and pricing | Variable |

| 6 | Settlement | Asset transfer and confirmation | Hours to 1 day |

Role of OTC Desk and Brokers

The role of OTC desk and brokers extends beyond simple trade execution to encompass market access, liquidity aggregation, and client service. OTC desks maintain relationships with liquidity providers, market makers, and other counterparties, enabling them to fill orders that exceed any single source’s capacity. This network effect creates liquidity solutions unavailable to individual traders.

Brokers also provide market intelligence, timing recommendations, and strategic guidance that adds value beyond execution. Experienced OTC professionals understand market dynamics, seasonal patterns, and optimal execution strategies that improve client outcomes. Understanding how sophisticated crypto exchange infrastructure supports OTC operations reveals the complexity behind seamless service delivery.

OTC Platform Selection Criteria

When choosing an OTC crypto platform, evaluate these factors:

- Security Infrastructure: Custody solutions, insurance, and operational security measures

- Liquidity Depth: Ability to fill large orders without significant delay or price impact

- Regulatory Compliance: Proper licensing and KYC/AML procedures

- Reputation: Track record, client references, and market standing

- Service Quality: Responsiveness, expertise, and personalized support

- Fee Transparency: Clear pricing without hidden costs

Choosing the Right OTC Crypto Platform

Choosing the right OTC crypto platform requires evaluating multiple factors that affect trading experience, security, and outcomes. Not all OTC services are equal, and selecting appropriate partners significantly impacts trading success. Systematic evaluation ensures partnerships with platforms capable of meeting specific requirements.

Security Features to Look For

Security features to look for in OTC platforms include cold storage custody with minimal hot wallet exposure, multi-signature transaction authorization, comprehensive insurance coverage, and transparent security audit results. These features protect assets during the trading and settlement process, reducing risks inherent in large-value transactions.

Operational security matters equally. Secure communication channels, identity verification procedures, and protection against social engineering attacks all contribute to overall security posture. Platforms should demonstrate commitment to security through certifications, audits, and transparent disclosure of practices.

Liquidity and Trading Volume Considerations

Liquidity and trading volume considerations determine whether a platform can execute trades efficiently at competitive prices. Platforms with deeper liquidity networks can fill larger orders without delays or unfavorable pricing. Ask about typical trade sizes, execution timelines, and liquidity sources to assess capabilities.

Trading volume history provides insight into platform experience and reliability. Higher volume platforms typically have more refined processes, better pricing due to scale, and more robust infrastructure for handling transactions.

Reputation and Trustworthiness of the Platform

Reputation and trustworthiness of the platform emerge from consistent performance, transparent operations, and positive client experiences. Research platform history, review public information about the team and company, and seek references from existing clients. Established platforms with long track records typically present lower counterparty risk.

Build Your Secure OTC Crypto Exchange Today

Create a secure, high-volume OTC crypto exchange with advanced features.

Launch Your Exchange Now

Fees and Settlement Speed

Fees and settlement speed affect transaction economics and operational efficiency. Compare pricing across platforms for similar trade sizes, understanding how fees scale with volume. Settlement speed matters for time-sensitive transactions and reduces exposure to market movements between trade agreement and completion.

Risk Notice: OTC cryptocurrency trading involves significant risks including counterparty default, market volatility, and regulatory changes. Conduct thorough due diligence on any OTC platform before trading. Never trade amounts you cannot afford to lose, and ensure full understanding of all terms before transaction commitment.

OTC Platform Evaluation Factors

| Factor | What to Look For | Red Flags |

|---|---|---|

| Security | Cold storage, insurance, audits | No audit history, unclear custody |

| Liquidity | Multiple sources, fast execution | Delays, limited asset coverage |

| Compliance | Licensed, KYC/AML procedures | No verification, unlicensed |

| Reputation | Established history, references | Unknown team, no track record |

| Fees | Transparent, competitive | Hidden costs, unclear pricing |

Conclusion

OTC crypto exchange platforms serve an essential function in cryptocurrency markets, enabling large-volume trading that standard exchanges cannot accommodate effectively. Understanding the key features of OTC exchanges, including secure transactions, high liquidity solutions, and personalized support, helps traders appreciate why institutional investors and high-net-worth individuals prefer these services.

The benefits of OTC cryptocurrency trading, from enhanced security to reduced market impact and faster settlement, make compelling cases for traders dealing with significant volumes. Learning how OTC crypto trading works, from registration through settlement, prepares participants for smooth transactions that achieve their trading objectives.

Choosing the right OTC crypto platform requires careful evaluation of security features, liquidity capabilities, reputation, and fee structures. The effort invested in platform selection pays dividends through better execution, enhanced security, and reliable service that institutional crypto trading demands.

Market Outlook: As cryptocurrency markets continue maturing, OTC trading infrastructure will become increasingly sophisticated. Expect improved technology integration, broader asset coverage, and enhanced compliance capabilities as the sector evolves to serve growing institutional demand.

The OTC cryptocurrency trading sector represents a critical infrastructure layer enabling serious market participants to transact at scale. Whether you are an institutional investor building significant positions, a high-net-worth individual diversifying into digital assets, or a business requiring large cryptocurrency transactions, understanding OTC trading provides the foundation for effective market participation.

Frequently Asked Questions

An OTC crypto exchange is a trading platform that facilitates direct cryptocurrency transactions between buyers and sellers outside traditional exchange order books. These platforms handle large volume trades privately, preventing market impact and price slippage. OTC desks connect institutional investors, high-net-worth individuals, and businesses seeking to buy or sell significant cryptocurrency amounts.

OTC cryptocurrency trading works through direct negotiation between parties, typically facilitated by OTC desks or brokers. Buyers and sellers agree on price, quantity, and settlement terms before executing the trade. The transaction occurs privately without affecting public order books, allowing large trades to complete at agreed prices without the slippage that would occur on traditional exchanges.

Institutional investors prefer OTC trading because it allows execution of large orders without moving market prices, provides personalized service with dedicated account managers, ensures privacy for trading strategies, and offers competitive pricing for high-volume trades. OTC platforms also provide compliance support, secure custody solutions, and faster settlement compared to exchange-based trading.

Minimum trade sizes for OTC crypto trading typically range from $50,000 to $100,000, though this varies by platform and cryptocurrency. Some OTC desks accept smaller trades of $10,000 or more, while premium institutional desks may require minimum trades of $250,000 or higher. These minimums ensure efficient use of OTC infrastructure designed for large-volume transactions.

OTC crypto trading fees typically range from 0.1% to 3% depending on trade size, cryptocurrency, and market conditions. Larger trades generally receive better rates due to economies of scale. Unlike exchange trading with visible fees, OTC pricing often includes the spread in quoted prices. Negotiation is common, and regular clients may receive preferential pricing based on trading volume.

OTC crypto trading is generally safe when using reputable platforms with proper security measures, regulatory compliance, and established track records. Key safety features include secure custody solutions, escrow services during settlement, KYC/AML compliance, and insurance coverage. However, counterparty risk exists, making platform selection critical for secure OTC transactions.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.